Ever wonder how blockchain networks stay secure and reliable? The unsung heroes are Validator Nodes!

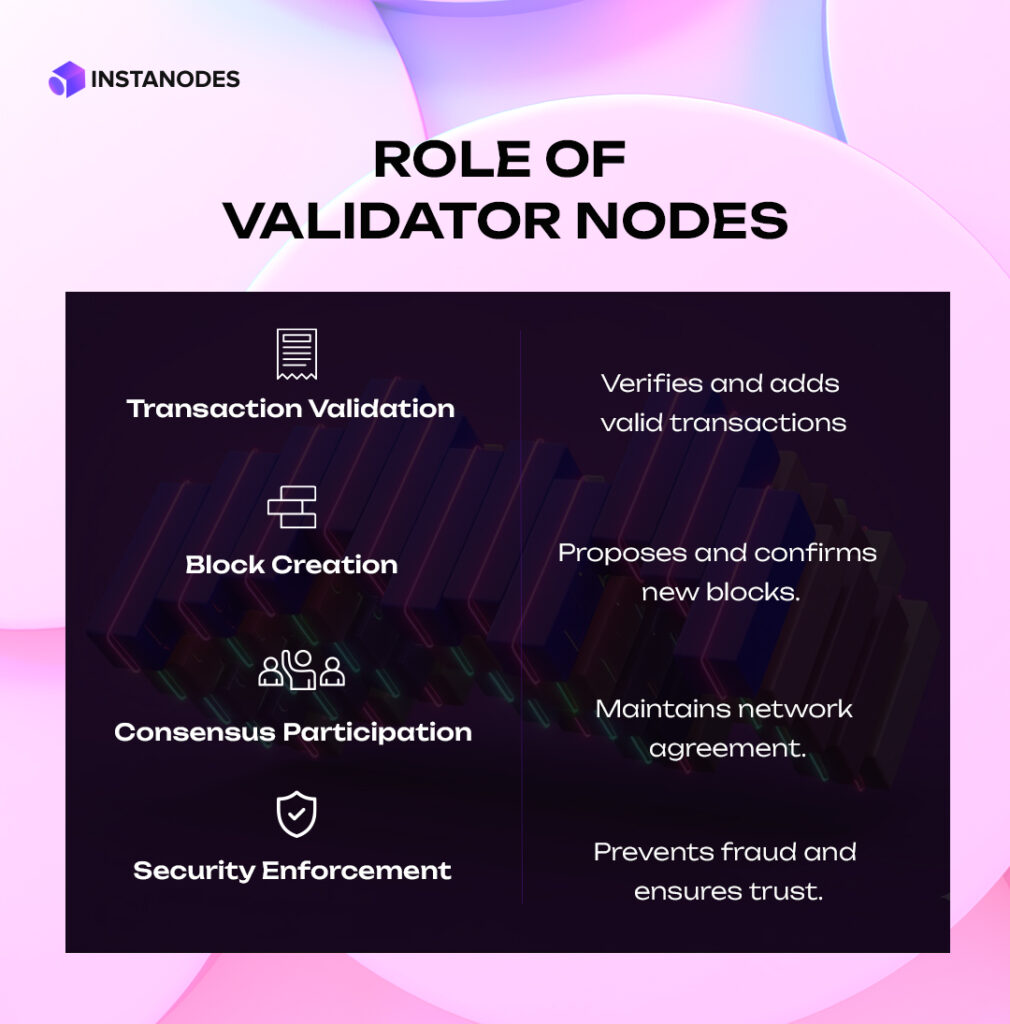

Crypto validator Nodes form the backbone of a blockchain network, as they play actively participate in the validation of transactions, creation of new blocks, and protect the integrity of the blockchain. They are most involved in governance and decentralization, keeping the network efficient and well-functioning. A Validator Node is the guardian of the well-being and security of the system.

Yes, it can be daunting but ultimately rewarding work. It requires technical expertise, specialized hardware, and enthusiasm for the success of the network. However, the reward is real: getting involved in consensus mechanisms, receiving rewards, and helping determine the future of decentralized tech.

Are you curious about becoming a validator? First, you must get a clear understanding of active validator services, the criteria of validator selection, the challenges of becoming a validator, and the right way of dealing with those intricacies.

What are Validator Nodes?

Validator nodes are specially designated participants on blockchain networks using Proof of Stake (PoS) or analogous consensus algorithms. Unlike miners on Proof of Work networks competing to solve intricate math problems, Proof of Stake validators are chosen to generate new blocks and validate transactions based on the quantity of cryptocurrency they’ve put up as collateral—a process called staking.

At their most basic form, these crypto validator nodes are machines operating blockchain software that are set up to engage in the process of consensus. Their hardware is usually specialized machines that have particular requirements in terms of processing power, memory, and storage space.

For example, an Ethereum validator has to hold 32 ETH as a stake and operate validator client software on a machine that has minimum hardware requirements. They get paid for their role in maintaining the blockchain’s integrity. It is also a simple way of ensuring passive income crypto staking. However, it will be necessary to understand how to run a validator node on Ethereum before taking a step toward becoming a validator.

Basically, Validator Nodes play the role of autonomous auditors, ensuring transactions’ authenticity and legitimacy before being incorporated in the blockchain. As transactions are packaged into blocks, validators cross-check them to ensure they’re valid, going through signatures, account balances, and other variables set by the protocol of the blockchain. On being validated, the blocks get appended to the blockchain, with a permanent, unalterable record of the transactions.

What sets validator nodes apart from normal full nodes is their active engagement in block production and their economic interest in the network’s prosperity. This economic incentive provides validators with a strong motivation to behave well since malicious activity threatens the loss of their staked funds through a penalty system called slashing.

Launch Your Validator Node

Launch your validator node and earn passive rewards while strengthening blockchain security!

Core Functions: Transaction Validation and Block Creation

The operational heart of a validator node revolves around two primary functions: validating transactions and creating new blocks.

Transaction Validation

When users make transactions on a blockchain network, they are placed in a mempool—a queue for unconfirmed transactions. Validator nodes extract transactions from the pool and execute a series of checks to validate their legitimacy:

- Signature Verification: Verifying that the owner of the sending address with the proper private key actually signed the transaction.

- Balance Verification: Ensuring that the sender holds enough funds to carry out the transaction.

- Nonce Checking: Verifying that the transaction sequence number is correct to prevent double-spending.

- Gas/Fee Assessment: Determining if the transaction includes adequate fees to process it (especially relevant on networks like Ethereum).

- Smart Contract Execution: For transactions involving smart contracts, validators must execute the contract code to verify its outcome.

The verification process acts as the initial line of protection against malicious use, stopping double-spending attacks and unauthorized transactions from being processed on the blockchain.

Block Creation

After validating transactions, crypto validator nodes bundle them into blocks according to the network’s specifications. The block creation process typically involves:

- Transaction Selection: Choosing which valid transactions from the mempool to include, often prioritizing those with higher fees.

- Block Assembly: Structuring the selected transactions into a block format that includes a reference to the previous block (creating the “chain”).

- Timestamp Application: Adding a timestamp to mark when the block was created.

- Block Proposal: Submitting the newly created block to the network for confirmation by other validators.

Ethereum employs a PoS consensus algorithm, and a Ethereum validator is chosen randomly to create new blocks using a process referred to as the beacon chain. Upon selection, a validator is tasked with creating a block in a time slot, which usually takes around 12 seconds. Missing a block creation when selected may incur penalties, decreasing the validator’s staked ETH.

The two-fold duties of transaction verification and block generation make validator nodes the central guardians of blockchain integrity, where only valid transactions are added to the permanent record.

Consensus Mechanisms: The Heart of Validator Operations

Consensus protocols are the philosophical and technical foundation of how validator nodes communicate and come to an agreement on the state of the blockchain. These protocols dictate how decisions are reached in a decentralized system where there is no central authority.

Proof of Stake (PoS)

In Proof of Stake systems, validators are chosen to build blocks proportionally to their economic stake in the network. This method minimizes the energy usage of Proof of Work mining while ensuring security through economic incentives.

Ethereum’s version of PoS, Casper, works by using its beacon chain to coordinate validators and handle the staking. Validators stake 32 ETH to take part in block creation and are rewarded for good behavior.

The key aspects of PoS consensus include:

- Economic Security: Validators must risk their own assets, creating a financial disincentive for malicious behavior.

- Energy Efficiency: Without competitive mining, energy consumption is drastically reduced compared to Proof of Work systems.

- Scalability Potential: PoS systems are capable of processing more transactions per second compared to their PoW counterparts.

Delegated Proof of Stake (DPoS)

Some blockchains such as EOS and Tron use Delegated Proof of Stake, in which token holders vote for a few validators (usually referred to as delegates or block producers) to lock up the network on their behalf. This method further centralizes validation duties but may enhance transaction throughput.

Practical Byzantine Fault Tolerance (PBFT)

Cosmos and Hyperledger Fabric blockchain networks employ derivatives of Byzantine Fault Tolerance protocols, which aim at building consensus even if there are malicious validators or failure cases. These systems most often need crypto validator nodes to exchange information heavily before completing the blocks, generating robust finality guarantees but possibly constraining scalability.

The consensus protocol used largely determines the behavior of validator nodes, their requirements in terms of resources, and the security features of the blockchain.

For example, an Ethereum validator needs to run several client software components in order to engage with its PoS consensus, whereas validators on other networks might need different technical prerequisites depending on their respective consensus protocols.

Validator Selection and Performance Monitoring

Making the selection of validators that will take part in consensus and observing their performance is of great significance as it ensures network health and security.

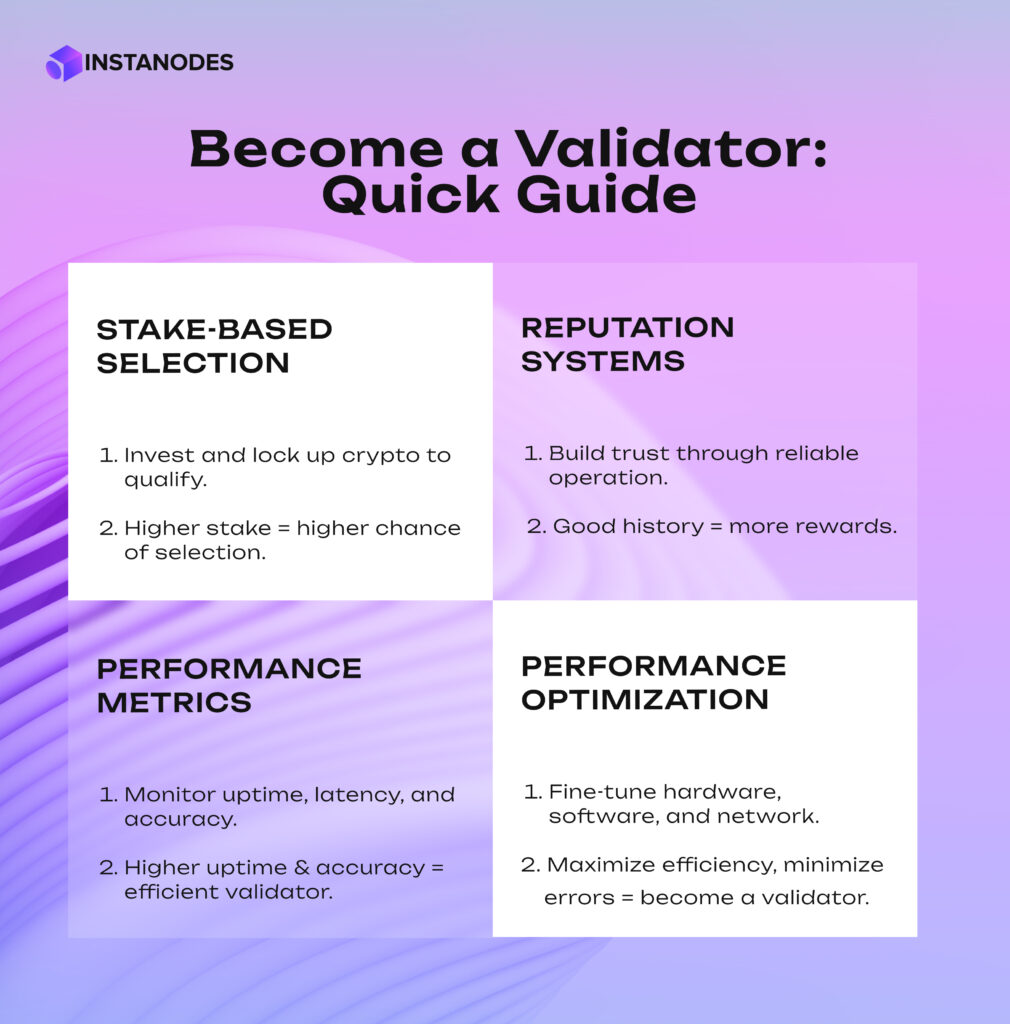

Selection Criteria

Different blockchains employ various approaches to validator selection:

- Stake-Based Selection: On Ethereum and similar networks, validators with a sufficient stake (e.g., 32 ETH) can activate validator status, though they may enter a queue before becoming active.

- Reputation Systems: Some networks incorporate historical performance metrics into selection probability, favoring validators with proven reliability.

- Random Selection: Within the pool of eligible validators, many systems use verifiable random functions to select block proposers, ensuring unpredictability and fairness.

For Ethereum specifically, the beacon chain manages validator activation, maintains a queue system when many validators attempt to join simultaneously, and handles the random selection process for block proposal and attestation duties.

Performance Metrics

Once active, validator nodes are continuously monitored across several key performance indicators:

- Uptime: The percentage of time a validator is online and responsive.

- Attestation Rate: How consistently the validator participates in voting on proposed blocks.

- Block Proposal Success: Whether the validator produces valid blocks when selected to do so.

- Slashing Events: Any instances of protocol violations that resulted in penalties.

These metrics not only influence rewards but also the validator’s reputation on the network. On Ethereum, the beacon chain monitors these figures using a scoring system that influences the validator’s eligibility for rewards and can activate penalties for bad performance.

Performance Optimization

Running a successful validator node requires ongoing optimization efforts:

- Hardware Scaling: Ensuring sufficient computing resources as network demands grow.

- Client Diversity: Using different client implementations to reduce systemic risks.

- Network Connectivity: Providing stable, low-latency internet connections.

- Monitoring Tools: Implementing alert systems to detect and respond to issues promptly.

Professional validation operations will frequently utilize high-level monitoring dashboards, dual systems, and fail-over procedures to ensure highest possible performance with the least possible downtime.

Start Validating Transactions!

We’ll set up your node and help secure the blockchain ecosystem

Security Measures: Protecting the Blockchain Network

Validators serve as primary security enforcers in blockchain networks, implementing multiple layers of protection against various attack vectors.

Slashing Mechanisms

Perhaps the most powerful security feature in PoS systems is slashing—the partial or complete forfeiture of staked assets for rule violations.

Actions that typically trigger slashing include:

- Double Signing: Producing two different blocks for the same slot.

- Equivocation: Voting for competing chains simultaneously.

- Long-Range Attacks: Attempting to rewrite blockchain history from a distant point.

For an Ethereum validator, slashing penalties can range from minor reductions for being offline to losing the entire 32 ETH stake for serious violations like intentional double-signing. This economic deterrent significantly raises the cost of attacking the network.

Security Against Common Attacks

Validator nodes implement specialized protections against known attack vectors:

- Sybil Resistance: The staking requirement prevents attackers from creating numerous fake identities to gain control.

- 51% Attack Prevention: The economic cost of acquiring 51% of staked assets makes such attacks prohibitively expensive.

- Long-Range Attacks: Social consensus and weak subjectivity checks prevent validators from rewriting ancient history.

- Nothing-at-Stake Problem: Slashing penalties solve the theoretical issue where validators might vote for multiple competing chains without consequence.

Network-Level Security

Beyond individual validator security, the collective behavior of crypto validator nodes provides network-level protections:

- Decentralization: A diverse, geographically distributed set of validators increases resilience against regional failures or regulatory actions.

- Client Diversity: Using multiple software implementations prevents single points of failure in the code.

- Attestation Committees: Many networks require multiple validators to attest to block validity, creating redundant verification.

The combination of economic incentives, technical safeguards, and coordination mechanisms enables validator nodes to maintain blockchain security even in adversarial environments where some participants may attempt to subvert the rules.

Governance and Decision-Making: The Influence of Validator Nodes

Validator nodes play a pivotal role in blockchain governance—the processes by which networks evolve and adapt over time.

On-Chain Governance

Many modern blockchains incorporate formal governance mechanisms where validators vote on protocol changes:

- Proposal Systems: Stakeholders (often including validators) can submit improvement proposals.

- Voting Mechanisms: Validators participate in voting, usually weighted by stake size.

- Implementation Thresholds: Proposals require specific approval percentages to be adopted.

Popular platforms such as Cosmos, Polkadot, and Tezos have advanced on-chain governance where validators are at the center of decision-making.

For instance, Tezos validators (“bakers”) vote on protocol changes in periodic upgrade cycles.

Ethereum Governance

Ethereum takes a more hybrid approach, using off-chain social consensus combined with on-chain execution:

- Ethereum Improvement Proposals (EIPs): Proposals for changes are made, debated, and shaped through an open process.

- Client Implementation: Multiple development teams incorporate accepted changes into their software.

- Validator Adoption: Validators choose whether to update their nodes to support new protocol versions.

While Ethereum doesn’t have formal on-chain voting, validators exercise considerable influence through their choice of which software clients and versions to run. Major upgrades require broad validator support to succeed.

Governance Responsibilities

Validators shoulder significant responsibilities in governance processes:

- Informed Participation: Staying educated about proposed changes and their implications.

- Community Representation: Often representing the interests of delegators or community members.

- Technical Evaluation: Assessing the security and performance impacts of upgrades.

- Signaling Support: Demonstrating commitment to changes through public statements or test network participation.

The concentration of stake among validators can sometimes raise concerns about plutocracy—rule by the wealthy—in governance decisions. To counter this, many projects implement mechanisms to ensure broader community input beyond just validator voting power.

Staking and Incentives: Why Validators Play a Crucial Role

The economic model behind validator operations is critical to comprehend their incentives and actions in blockchain systems.

Staking Requirements

Different networks set varying thresholds for validator participation:

- Ethereum: Requires exactly 32 ETH per validator node.

- Cosmos: The minimum stake varies by blockchain in the ecosystem.

- Polkadot: Utilizes a dynamic nomination scheme that chooses validators by total stake.

These criteria impose entry barriers that ensure validator nodes have substantial skin in the game while avoiding undue centralization.

Reward Mechanisms

Validators earn rewards through several mechanisms:

- Block Rewards: New tokens are issued when validators create blocks.

- Transaction Fees: A portion of fees paid by users for transactions.

- Attestation Rewards: Payments for participating in consensus by voting on blocks.

On Ethereum, validators currently earn approximately 3-5% APR on their staked ETH through a combination of these reward types. The exact percentage fluctuates based on the total number of active validators—more validators means the rewards are split among more participants.

Passive Income Through Staking

For many participants, validator operation represents an attractive passive income opportunity:

- Consistent Returns: Unlike volatile trading, staking provides relatively stable yields.

- Compound Growth: Rewards can be automatically restaked to increase future earnings.

- Network Participation: Stakers contribute directly to network security while earning.

The increasing popularity of “passive income crypto staking” has driven growth in both direct validator participation and delegated staking services, where users pool their assets with professional validators.

Delegation and Staking Services

Not everyone has the technical skills or minimum stake required to run a validator node.

Staking services bridge this gap:

- Pooled Staking: Services like Lido and Rocket Pool allow participation with less than 32 ETH.

- Exchange Staking: Platforms like Coinbase and Binance offer simplified staking for retail users.

- Professional Operations: Some entities specialize in running “active validator services” for institutional clients.

These services typically charge a percentage of staking rewards (usually 5-15%) in exchange for handling the technical complexities of validator operation.

How to Run a Validator Node on Ethereum

For those interested in operating their own Ethereum validator, the process involves several key steps:

Hardware Requirements

Successful Ethereum validators need appropriately specified hardware:

- Processor: Modern CPU with 4+ cores (Intel i5/i7 or AMD Ryzen)

- Memory: Minimum 16GB RAM, with 32GB recommended

- Storage: At least 2TB SSD storage for the blockchain data

- Network: Reliable broadband with a minimum of 10 Mbps upload/download speeds

- Power: Uninterrupted power supply to prevent downtime

While these requirements aren’t extreme, they exceed typical home computer specifications, particularly regarding storage and reliability needs.

Software Setup

The software stack for an Ethereum validator includes:

- Execution Client: Software that handles transaction processing (e.g., Geth, Nethermind, Besu)

- Consensus Client: Software that coordinates validation (e.g., Prysm, Lighthouse, Teku, Nimbus)

- Validator Client: Software that manages staking keys and signing duties

- Monitoring Tools: Solutions for tracking performance and receiving alerts

Client diversity is strongly encouraged, as running different client combinations helps protect the network against bugs in any single implementation.

Staking Process

The actual staking procedure involves:

- Generate Keys: Create validator keys using the deposit CLI tool.

- Fund Deposit Contract: Send 32 ETH to the Ethereum staking contract.

- Configure Clients: Set up and synchronize both execution and consensus clients.

- Activate Validator: Import validator keys and wait for activation (currently takes several days due to the activation queue).

- Monitor Performance: Once active, continuously monitor validator performance and maintain uptime.

The entire process requires considerable technical knowledge, especially for secure key management and ongoing maintenance.

Costs and Return Calculations

Running an Ethereum validator involves both upfront and ongoing costs:

- Staking Amount: 32 ETH per validator (approximately $50,000-$100,000 depending on market conditions)

- Hardware Costs: The cost of having a dedicated validator setup varies for different regions.

- Electricity: Depends on local rates

- Internet: Reliable broadband connection

Against these costs, validators can expect rewards of approximately 3-5% annually on their staked ETH. For a single validator with 32 ETH, this translates to roughly 1-1.6 ETH per year in current conditions.

Challenges Faced by Validator Nodes and Resolution

Validator nodes form the backbone of modern Proof of Stake blockchains, but operating them successfully involves navigating numerous technical, economic, and regulatory challenges. Understanding these obstacles and their potential solutions is crucial for maintaining network health and validator profitability.

| Becoming a Validator Node- Key Challenges and Solutions | ||

| Challenge | Description | Solutions |

| Hardware Failures | Physical equipment malfunctions causing missed attestations and rewards |

|

| Network Connectivity Issues | Unstable internet connections leading to reduced validator performance |

|

| Client Software Bugs | Software errors that can cause slashing or missed rewards |

|

| Security Vulnerabilities | Potential for key theft or unauthorized access |

|

| Regulatory Uncertainty | Unclear legal status of staking operations in many jurisdictions |

|

| Centralization Pressures | Economic incentives favoring large-scale operations |

|

| MEV Extraction Ethics | Moral and economic questions around extractable value |

|

| Liquidity Constraints | Locked capital during staking periods limiting flexibility |

|

| Slashing Risks | Potential for penalties due to double signing or other violations |

|

| Economic Sustainability | Fluctuating rewards and increasing competition |

|

How Instanodes Helps to Set Up Validator Node

Instanodes simplifies validator node setup through:

- Automated deployment with pre-configured templates that eliminate complex manual installations

- Intuitive dashboard for monitoring node performance, rewards, and network status

- One-click updates when protocol changes occur, ensuring validators stay current

- Built-in security features including automatic firewall configuration and key management

- Technical support from blockchain specialists who assist with troubleshooting

- Multi-chain support enabling validators to diversify across various networks

- Provides pre-synchronized nodes, significantly reducing the initial syncing time which can take days or even weeks.

- Intelligent scaling that automatically adjusts resources based on network demands

- Cost optimization through cloud resource management that reduces unnecessary expenses

- Backup/recovery systems protecting against data loss or corruption

- Educational resources guiding users through validator requirements and responsibilities

Conclusion

Validator nodes form the backbone of blockchain security and governance. They foster decentralization and innovation through secure transaction validation, network integrity preservation, and contribution to governance.

With increasing active validator services, crypto validator nodes, and passive income crypto staking, the blockchain technology will remain secure.

Want to become an Ethereum node, or simply curious to understand how to run a validator node on Ethereum before making an investment? Consult Instanodes!

We create and maintain nodes for you, making your networks decentralized, secure, and efficient. Don’t hesitate, let’s have open discussions.